Executive Summary: The State of Play for 2025

2025-11-24

Strategic Report 2025/2026: Asset Profitability and Technological Transformation in the Metal Industry

Author: Marcin Białczyk, Expert in Valuation and Industrial Technology Transfer

Read time: 8 minutes | Published: November 2024

Executive Summary: The State of Play for 2025

The metalworking sector is entering a phase defined in macroeconomic analyses as the "Hyper-Efficiency Era." With industrial sentiment indices fluctuating and steel consumption forecasts showing only marginal growth (+2.2%), the margin for investment error has effectively vanished.

At wesellmachines.com, we identify a fundamental paradigm shift: a transition from a Growth-at-all-costs strategy to Asset Utilization & Cash Flow Protection. In this report, we analyze why the key to survival in 2025-2026 is not buying "new," but buying "efficient"—often from the secondary market.

1. Cost Analysis: OEE and TCO as the New Industrial Currencies

In the Industry 4.0 era, purchasing decisions cannot be based solely on catalog prices. The critical metric is now OEE (Overall Equipment Effectiveness) correlated with TCO (Total Cost of Ownership).

The market data is relentless:

- Energy Costs: Now account for up to 15-20% of operational costs in laser processing.

- Depreciation: A new premium machine (e.g., Trumpf, Amada) loses approximately 20-25% of its value the moment it is installed, and another 10-15% within the first year.

- Lead Time: Waiting times for new machining centers from top OEMs remain between 6 to 12 months, freezing down-payment capital and blocking the acceptance of immediate contracts.

2. The Premium Secondary Market: A Strategic Alternative to CAPEX

Many managers suffer from a cognitive bias, equating "modernity" exclusively with the current production year. However, from an engineering perspective, a 3-4 year old machine from brands like Mazak, Trumpf, or Bystronic—maintained according to OEM specifications—offers 95-98% of the performance of a new unit, at a purchase cost 40-60% lower.

Technological Arbitrage at wesellmachines.com

On the wesellmachines.com platform, we introduce the model of a verified secondary market. Why is this critical for the 2025-2026 strategy?

- Immediate Operational Liquidity: Machines available on our platform are ready for relocation. We eliminate "Time-to-Market" issues—you buy today and produce next week, generating cash flow faster than competitors waiting for OEM delivery.

- Structural Stability: Older machine frames (often cast from seasoned nodular iron) exhibit superior vibration damping compared to modern, lightweight welded structures, translating to higher precision when machining hard materials.

- Lower Entry Barrier for Fiber Technology: A used 4kW or 6kW Fiber laser allows you to enter the precision cutting market with a budget that would only cover a basic plasma cutter if buying new.

3. The Physics of Savings: Why Fiber and Servo are Mandatory

Whether choosing a new machine or one from our used inventory, the technology must be backed by mathematics.

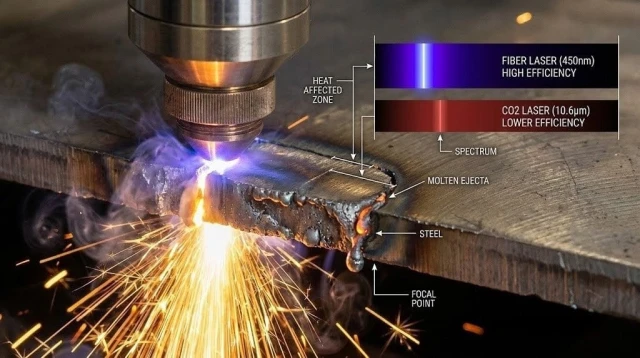

Laser Fiber vs. CO2: A Difference at the Photon Level

The advantage of Fiber is not marketing; it is physics. Radiation with a wavelength of 1.064 micrometers (Fiber) is 10 times better absorbed by metals than the 10.6-micrometer wave (CO2). This means:

- Energy Density: Higher energy focused in a smaller spot.

- Wall-plug Efficiency: Fiber achieves >35%, while CO2 rarely exceeds 8-10%. With current industrial MWh prices, replacing an old CO2 laser with a used Fiber unit pays for itself in electricity bill savings alone within 18-24 months.

Press Brakes: The Servo-Electric Era

In the secondary market, servo-electric presses are becoming increasingly available. Their advantage over hydraulics lies in the absence of proportional valves and idling pumps. Energy consumption occurs only during the beam movement stroke. This results in an operational cost reduction of approx. 50% and eliminates the risk of oil leaks (ISO 14001 environmental aspect).

4. "Retrofit & Trade-In" Modernization Strategy

As an expert, I recommend a hybrid approach. Not every machine needs to be new, but every machine must be efficient and digitally integrated.

The Wesellmachines Operating Model:

- Technical Audit: We verify the condition of the spindle, linear guides, and CNC controls (Fanuc, Siemens, Heidenhain).

- Real Valuation: We determine the market value of your current asset.

- Trade-In: We buy back your old technology, freeing up capital to purchase a more efficient unit from our stock.

This approach allows for the modernization of the machine park without engaging full external financing, which is a key competitive advantage in a high-interest-rate environment.

Summary: Financial Engineering in Practice

The year 2025 will force a brutal verification of efficiency on manufacturing companies. The winners will be those who understand that a machine earns money when it cuts, not when it is new.

Expert Recommendation:

Before you sign a lease for a new machine with a 9-month delivery time, check our immediately available offers. It often turns out that a 3-year-old Fiber Laser with 15,000 operational hours will allow you to fulfill the same contracts, with an ROI that is twice as fast.

Check current availability: Wesellmachines.com Metalworking Machinery Catalog

Content added:

BIAŁCZYK Sp. z o.o.

BIAŁCZYK Sp. z o.o.

Log in with Facebook

Log in with Facebook Log in with Google

Log in with Google