CNCマシンの評価:帳簿価格(減価償却)が市場価格(買戻し価格)と無関係である理由

2025-11-13CNC Machine Valuation: Why Book Value (Depreciation) Has Nothing to Do with Market (Buyback) Price

As a long-time specialist in industrial machine valuation and an expert at the WeSellMachines.com platform, I regularly encounter one of the most costly errors in the financial management of manufacturing companies. This error is equating a machine's book value with its real market value.

The scenario is a classic: A Chief Financial Officer (CFO) looks at the balance sheet and sees that an 8-year-old CNC machining center is fully depreciated, with a net book value of $1. They, therefore, treat it as a "worthless" asset. Meanwhile, I, as a secondary market expert, submit an offer to buy that same machine for $35,000. Where does this discrepancy come from?

The answer is simple: Management is looking at a historical tax fiction, while the market is looking at real production capability. This article is a practical guide for every CFO and business owner who wants to stop losing money and start strategically managing the value of their machine park.

Defining Net Book Value: The Tax Fiction

Net book value is a purely accounting and tax construct. Its life begins with establishing the initial value—this is the purchase price of the machine plus all costs related to its adaptation for use (e.g., transport, assembly, first start-up).

From that moment, the process of depreciation begins, which is not a measure of the machine's actual physical wear and tear. Depreciation is merely the accounting-based spread of the historical cost over time, primarily aimed at tax optimization (generating a tax-deductible expense).

In many jurisdictions (e.g., in Poland, according to the Classification of Fixed Assets, KŚT), machine tools for metalworking (like KŚT 410 - Lathes) have a standard annual linear depreciation rate of 14%.

The simple math: 100% of value / 14% per year = ~7.14 years.

This means that after about 7-8 years of standard depreciation, the machine's net book value (initial value minus accumulated depreciation) drops to zero or a symbolic $1. From the perspective of the balance sheet and the tax office, this machine is worthless.

Defining Market Value: The Transactional Reality

Market value is a completely different category. It is the most probable price that a real buyer is willing to pay for the machine at a given moment, in an open and competitive market.

It is this value, not the book value, that key financial institutions rely on:

-

Banks: When granting a loan secured by a machine park, the bank ignores accounting records. It is only interested in an appraiser's report that determines the real market value of the collateral.

-

Leasing Companies: When setting leasing terms (especially for used machines), they base their calculations on a market assessment, which determines the residual value and risk.

-

Insurers: Market value (or replacement value) is the basis for calculating the premium and, more importantly, the amount of any potential claim payout.

At WeSellMachines.com, our daily work is precisely the analysis of this real value. We verify hundreds of machines a year and know perfectly well that the market pays for production potential, not for accounting entries.

The Striking Example: How $1 on the Balance Sheet Becomes $35,000

To provide a concrete example, let's use a real-world market case.

-

Machine: A popular Haas VF-2ss milling center.

-

Purchase: Year 2017.

-

Initial Value (with options): approx. $110,000.

Accounting Scenario (November 2025): 8 years have passed. The machine is fully depreciated (at a 14% rate).

-

Net Book Value: $0.

Market Scenario (November 2025): The machine was regularly serviced, is in good technical condition, and has complete documentation.

-

Real Market Value (Buyback Price): approx. $30,000 - $37,000 (based on analysis of current market listings for this model and year ).

A CFO who sells this machine "for scrap" based on its book value would be stripping the company of an asset worth over $30,000. This is a classic example of "hidden capital" or a "hidden asset" lying dormant on the balance sheets of manufacturing companies.

Key Market Valuation Factors: What the Accountant Doesn't See

As valuation experts, we ignore book value during a machine inspection. We focus on the factors that actually dictate the price on the secondary market.

1. Brand and Reputation (Haas vs. DMG Mori)

A brand is a promise of quality. Machines from premium manufacturers, like DMG Mori, are known for exceptional structural rigidity, higher precision, and reliability. Therefore, they hold their value much better on the secondary market than budget-friendly machines. The difference in the buyback price between a 10-year-old Haas and a 10-year-old DMG Mori with similar parameters can be drastic.

2. Technical Condition and History (Operating Hours > Age)

The market doesn't buy the year, it buys the mileage. The key parameter is operating hours (or spindle hours). An 8-year-old machine with a symbolic 1,600 operating hours is more valuable to the market than a 4-year-old machine that ran non-stop on three shifts. Regular service, lack of leaks, and the condition of the guideways are other critical elements.

3. Complete Documentation (CE + DTR) – The Machine's "Passport"

This is an absolutely critical factor that can reduce a machine's value to zero.

-

DTR (Technical and Operational Documentation): This is the "passport" for the machine. Without it, operation, maintenance, and fault diagnostics are a nightmare. The seller (even of a used machine) is legally required to provide the DTR. Its absence is a red flag and a guaranteed price reduction by at least the cost of its (often difficult) re-creation.

-

CE Declaration of Conformity: This is the machine's "right to work" within the EU. A machine without a CE mark (or with a falsified one) cannot be legally operated. In the event of an inspection by a state labor inspectorate (like Poland's PIP), it risks an immediate halt to operations. The market value of such a machine is solely its scrap value.

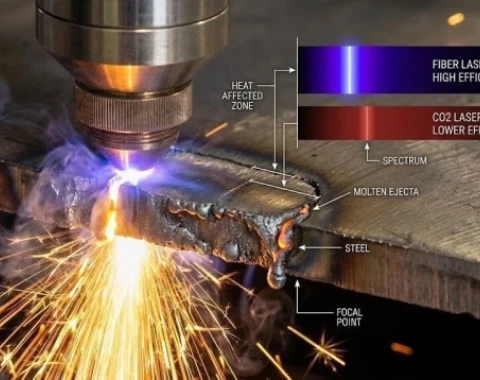

4. Technological Advancement (The "Tech Cliff")

A machine can be mechanically sound, but if it has an obsolete, unsupported control system, it falls off the "technological cliff". Its market value plummets because buyers fear a lack of parts and support.

5. Modernization (Retrofit)

On the other hand, a machine that has undergone a professional retrofit (e.g., a new control system, new motors) gains a "second life." Such a modernization can extend its lifespan by 10-15 years and radically improve its precision. Its market value increases significantly, often by more than the cost of the modernization itself.

Implications for the CFO: The 3 Biggest Risks of Ignoring Market Value

Basing strategic decisions on book value generates three powerful areas of financial risk:

Risk 1: Catastrophic Under-insurance of Assets

This is the most common and dangerous mistake. The company insures its machine park for a sum equal to its book value (which is near-zero). In the event of a total loss (fire, flood), the insurer pays out a near-zero claim. Meanwhile, the real cost of replacing the production capacity (even with used machines) is high. This gap often leads companies straight to bankruptcy.

Risk 2: Undervalued Borrowing Capacity

The company applies for a working capital or investment loan. The bank analyzes the balance sheet and sees a zero value for key production assets. The result? A loan refusal or much worse terms due to a lack of solid collateral. Having current market valuation appraisals for these machines completely changes the company's negotiating position.

Risk 3: Selling Assets Below Value

When the company decides to replace a machine, management, convinced of its zero value, accepts the first offer "for scrap." In this way, the company loses thousands of dollars in "hidden capital" that it could have used to finance a new investment.

A Partner in Valuation: How WeSellMachines.com Unlocks "Hidden Capital"

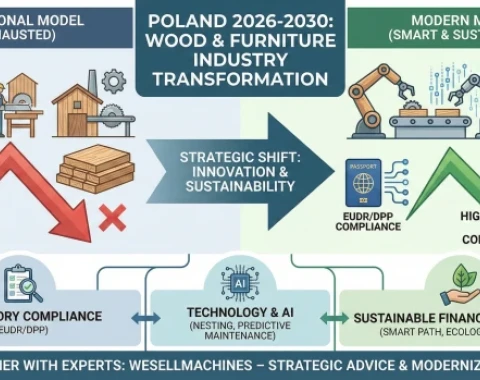

At WeSellMachines.com, we understand this discrepancy. Our mission is not just to broker sales, but to provide strategic advice on asset management.

-

Professional Market Valuation: Instead of guessing, we offer our partners a real market valuation. We base it on hard transactional data and thorough technical inspections.

-

Legal and Technical Audit: As a platform offering verified machines, we place enormous importance on verification. We check the technical condition and the completeness of the documentation (CE/DTR). We help sellers prepare the machine for sale to maximize its value.

-

Buyback as a Form of Financing: We don't treat your old machines as a problem, but as assets. By offering a fair buyback based on market value, we provide you with real capital that you can allocate to modernization , automation , or investments in Industry 4.0 technologies.

CNC Machine Valuation: Frequently Asked Questions (FAQ)

Question: Can I lease a machine that is 10 or 15 years old? Answer: Absolutely. Reputable leasing companies look at market value and technical condition, not chronological age. Financing is available for used machines, even those over 20 years old, provided their technical condition allows for further, safe operation.

Question: What lowers a machine's value more: age or operating hours? Answer: Operating hours, by a wide margin. An 8-year-old machine with low, documented hours will be much more valuable than a 4-year-old machine that ran non-stop on three shifts.

Question: I bought a machine without a CE Declaration of Conformity. What now? Answer: This is a serious legal and financial problem. Such a machine cannot be legally operated in the EU. In the event of a state labor inspection, you risk an immediate production halt. Its market value is close to zero (or its scrap value). You should immediately commission a professional safety audit and (if possible) undertake the costly certification process.

Question: Is a "retrofit" (modernization) of an old machine worthwhile? Answer: In many cases, yes. A professional modernization, such as replacing the control system, can not only extend the machine's life by 10-15 years but also radically increase its precision and efficiency. The cost of retrofitting is often much lower than buying a new machine, and the market value of such a modernized unit increases significantly.

Recommendations for Management: 5 Steps to Strategic Machine Park Management

-

Treat Depreciation as a Tax Tool Only. Never use book value as a basis for business, insurance, or investment decisions.

-

Maintain Dual Value Ledgers. In addition to accounting records, maintain an internal register of the estimated market value of key machines, updated every 2-3 years.

-

Insure for Market Value (Replacement Cost). Review your insurance policies. Ensure you are insuring machines for the amount that will actually allow you to replace your production capacity after a loss , not for the worthless amount on the balance sheet.

-

Treat Documentation (CE/DTR) Like Gold. Archive and secure the "passports" for your machines. Their loss is a real, measurable financial loss upon resale.

-

Consult with Market Experts. Before you sell a machine "for scrap" or overpay for a used one, contact the experts. At WeSellMachines.com, we will help you precisely determine the real value of your assets and unlock the capital frozen in your machine park.

追加されたコンテンツ:

BIAŁCZYK Sp. z o.o.

BIAŁCZYK Sp. z o.o.

ログイン Facebook

ログイン Facebook ログイン Google

ログイン Google